Op-Ed: The Gambling Mind

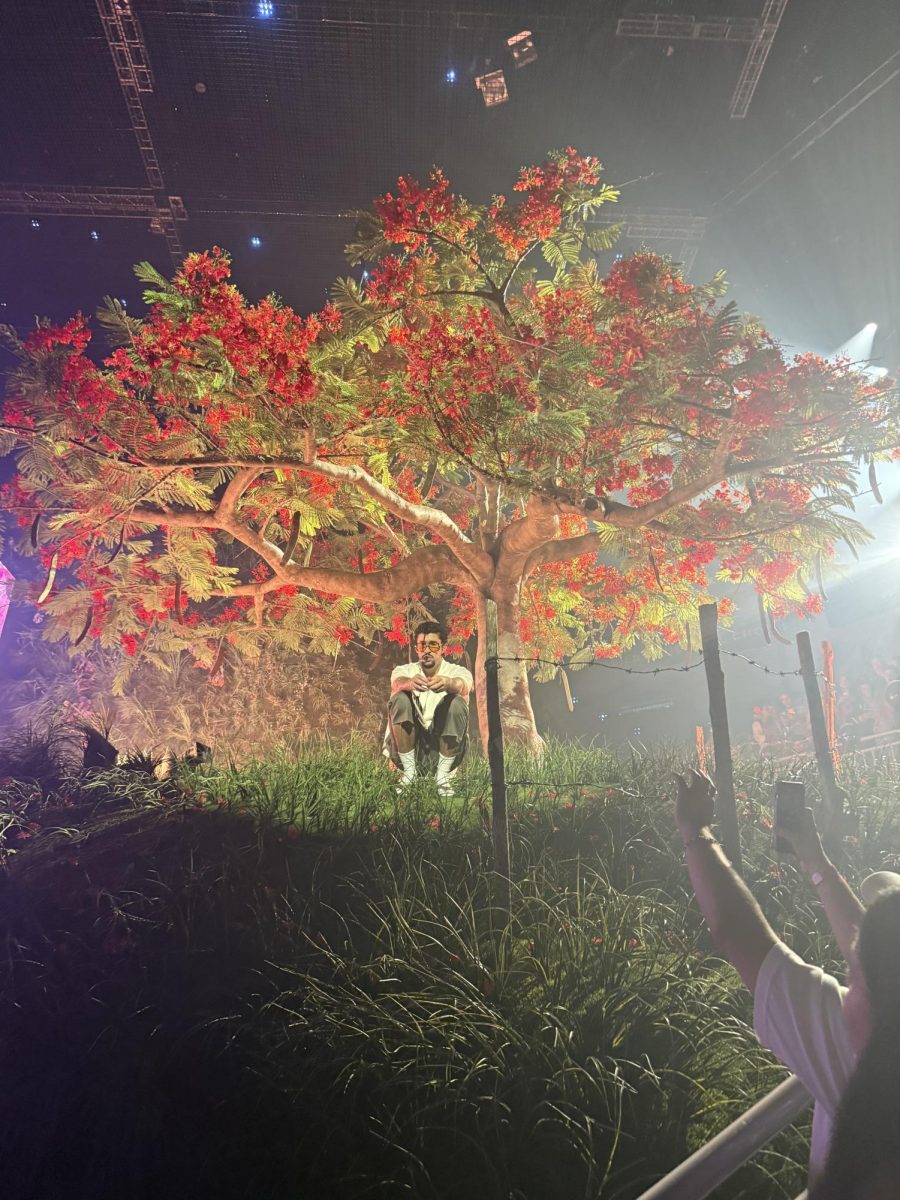

Gamer play casino roulette at a table in a casino. Betting gambling poker roulette background concept. Photo purchased from BigStock.com.

April 24, 2020

According to the laws of economics, people are rational.

But these laws don’t seem apply to gambling, which historians trace as far back to 3,000 B.C. Gambling has never been a rational activity, because who would invest money into something with an average negative 5% return. On average, everyone that goes into a casino with $100 will walk out with a little less than $95.

So, why do people gamble? What is the psychology, math, and economics behind Las Vegas’ favorite pastime?

Considering that people are rational, it confuses economists why people spend so much money at casinos—essentially giving away their money.

A U.S. National Library of Medicine poll asked people if they would rather have a 100% chance of $5 or an 80% chance of $6.25. While the two offers seem to be different, if played infinite times by the same players, 80% of $6.25 would average to $5. So, based on pure mathematics, players shouldn’t have a preference because these two choices are effectively equal.

However, over 75% of players stated that they would rather take the 100% chance of $5. Most economists would argue that this is due to the depressed feeling of missing out on $5, which outweighs the good feeling that might come with winning $6.25.

Interestingly, this breakdown changes with amounts. Under the same conditions, when asked if players would rather have a 100% chance of $5 or a 25% chance of $20, they were evenly split.

Also under the same conditions, when asked if they would rather have a 100% chance of $5 or a .5% chance of $1,000, about 75% of players chose a 0.5% chance of $1,000.

As the odds became higher, more players chose the gamble over the guaranteed $5. This is because we like the idea of low-risk gambling. As a species, it turns out, we prefer a small chance of winning big than receiving a smaller, guaranteed sum.

This idea of low-risk gambling can be seen in other areas of betting, too. For example, with horse racing, players would rather bet on horses that have a small chance of winning but have odds of 200/1 than bet on a horse that has a chance of winning with odds of 2/1.

A report on decision making in uncertain situations by economists Erik Snowberg and Justin Wolfers show that more often than not, the top horse has better than 2/1 odds of winning, but such rankings are deflated because people would rather bet on the underdog. Similarly, horses that have a lower chance of winning typically have lower odds than 200/1, but these odds are inflated because gamblers are willing to bet on them.

When it comes to explaining this human behavior, New York Times columnist David Leonhardt puts it best:

“People overestimate the chances of a low-probability event(s)… as is the case with plane crashes. One example I didn’t have room to mention in the magazine is what economists refer to as the “favorite-longshot bias.” It holds that gamblers tend to over-bet underdogs and under-bet favorites. For the same reason that people are afraid of dying in a plane crash although the chances are incredibly small, is the same reason people are willing to bet on the underdog despite odds not being in their favor.”

At the end of the day, it comes down to the size of potential winnings. Casinos are happy to let people gamble because their coffers are making at least 5%, and people are happy to gamble because of the potential to make serious bank.

Jason • Apr 26, 2020 at 6:37 pm

Nate – I would make the argument for the appeal of the $1,000 payout as such:

If you do expected values for payouts on the 100% chance of $5 vs 0.5% chance of $1,000 you end up with the same outcome (for large groups) – $5 per person. (1,000 * .005 = 5*1.0). Of course w/ the $1,000 gamble you can’t actually get $5 – you’ll either get nothing or $1,000. So then look at the risk vs reward – you could be promised $5 or have a slim chance at $1,000. While free money to the tune of $5 certainly isn’t something to turn away, it likely won’t change many lives (at least in the US economy) whereas $1,000 for many could be really important.

In the scenario of 100% of $5 vs 0.5% chance of $1,000 I think it’s also important to know is the person putting up $5 for this prize? If it’s $5 for $5, unless the actual game is fun, I don’t know why anyone would do that vs $5 for the potential to turn it into $1,000 (albeit it very unlikely) seems to be less of a waste of time (but more of a waste of money.)

In any event – interesting topic.